Debt Contracts

Default resolution:

● US bankruptcy laws feature the automatic stay, which prohibits asset seizure to prevent disruptions to orderly resolution.

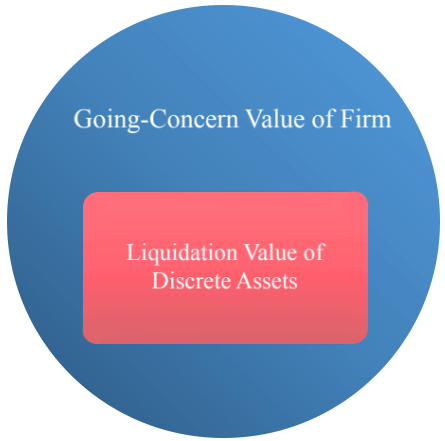

● In Chapter 11, total payments to claimholders are driven by the going-concern value (i.e., the value of the company as an operating business).

Organizing Framework:

Two Perspectives of Looking at a Firm

Corporate debt contracts in the US can be based on these two perspectives.

“Dead”

Liquidation value of particular assets

“Alive”

Firm value as an operating business

(going-concern value)

#1 Asset-based debt: lenders focus on the intrinsic liquidation value of discrete assets, such as fixed assets or working capital.

Lenders take security in these assets and obtain priority with respect to their liquidation value (i.e., lenders have senior claims equal to this value even without asset seizure).

Assets pledged: equipment, structures, working capital (inventory, receivables). They can generate liquidation value on their own; some separable intangibles (e.g., usage rights, patent) can also be pledged.

Borrowing limit: appraised liquidation value of particular assets pledged

The main advantage of this approach is that lenders need to worry less about the merit of the business. However, many firms have few generic assets, which limit the usefulness of this approach.

#2 Cash flow-based debt: lenders rely on the going-concern value of the business, which may benefit from human and organizational capital. Have claims against the company, not particular assets.

In the US, lenders can take security in the firm as a whole (e.g., implemented by blanket liens) and obtain priority with respect to the going-concern value (minus the value of assets separately pledged).

Borrowing limit: not tied to liquidation value, typically tied to operating earnings

Since lenders’ payoffs are closely tied to the value of the business, monitoring firm performance can be especially important.

They have claims effectively against different aspects of the firm

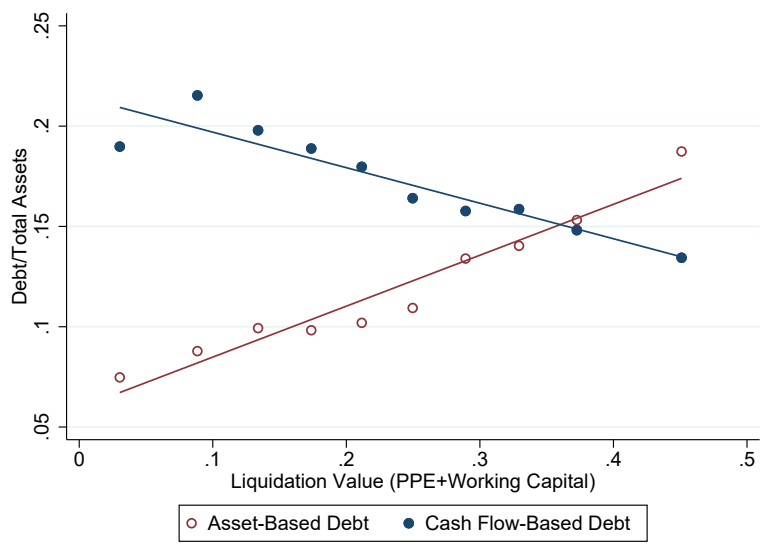

Debt Composition in Aggregate and across Firms

Aggregate nonfinancial corporate debt outstanding by value

● 20% asset-based debt, 80% cash flow-based debt

(Lian and Ma, 2021)

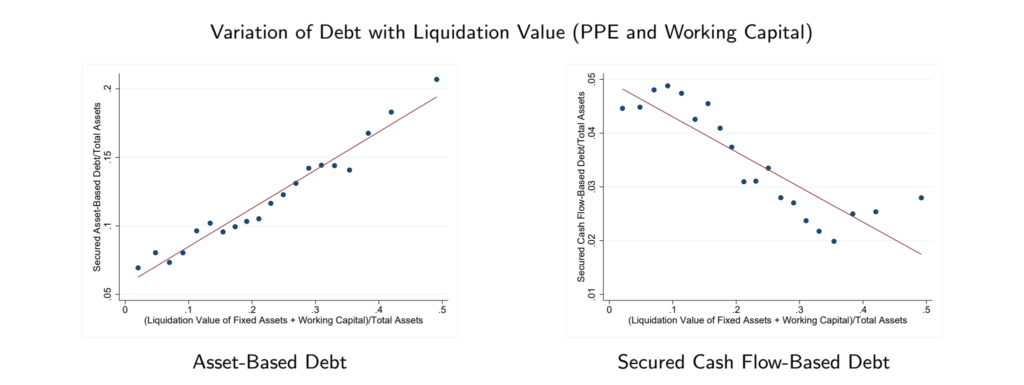

Debt composition differs

across industries

● E.g., industries differ systematically in their liquidation values (see previous slide)

Debt composition differs by firm size and earnings

● Small, low earnings firms have more asset-based debt

● Large, high earnings firms have more cash flow-based debt

Debt composition can also

differ across countries

differ across countries

● Asset-based debt more prevalent when bankruptcy is liquidation-oriented

● Cash flow-based debt more prevalent when orderly restructuring is easier (Lian and Ma, 2021)

● Accounting quality (which affects cash flow verifiability) can also matter

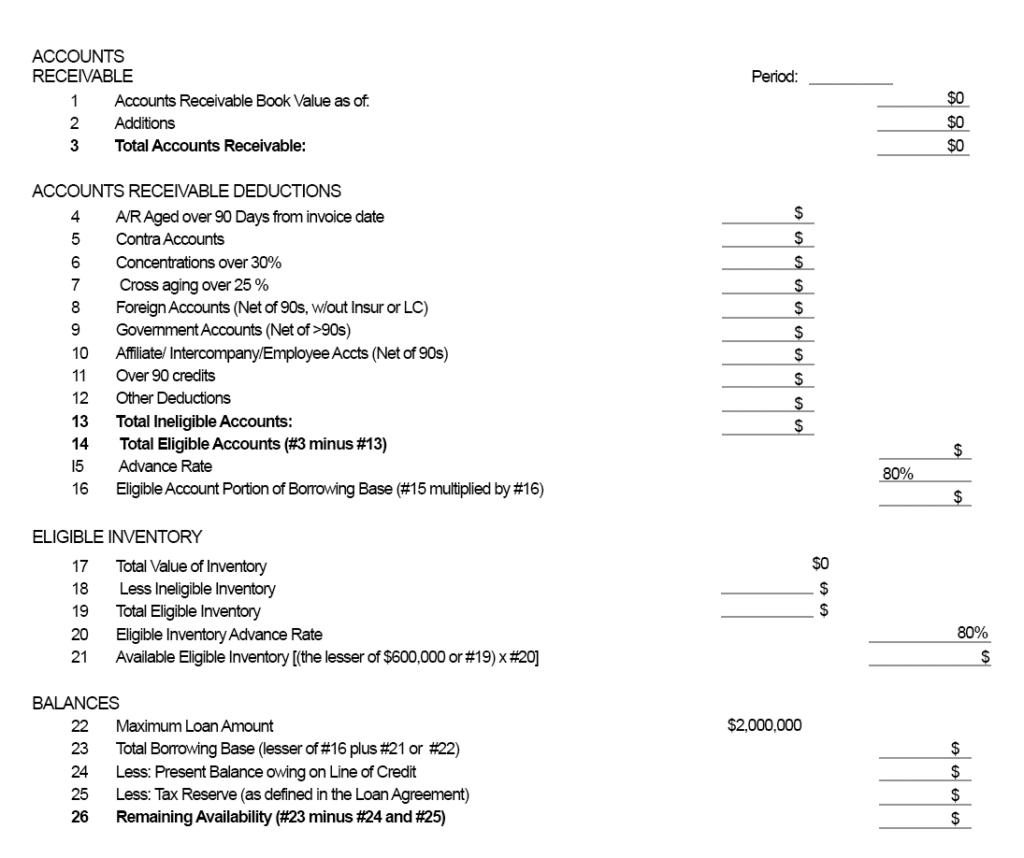

Debt Limit: Asset-Based Debt

Have claims against particular assets; contractual borrowing constraints bABL ≤ qk

● q based on appraised net orderly liquidation value

● k is book value of eligible assets, can include receivable, inventory, fixed assets, IP

● This constraint applies to a given asset-based debt (not total debt of firm)

● Structure somewhat resembles margin loans in financial markets

Compliance typically required on a quarterly or monthly basis

● Violation is a contractual breach

Take security interest in the particular assets pledged

● Have exclusive priority over the value of these assets; but not value of other assets

Specifically:

1. Borrower pledges particular assets (e.g., receivable, inventory, machinery/equipment)

2. Lender appraises NOLV of assets pledged

► Third-party appraisers, who are also the primary liquidators/market makers of real assets

► They conduct field examinations of assets pledged, simulate liquidations

3. Lender sets “advance rate” (tied to NOLV): % of book value that can be pledged

4. Lender defines “borrowing base” = ∑ j Advance rate j × Eligible book value j

► Asset type indexed by j; some parts of assets deemed ineligible

5. Every quarter/month, borrower presents borrowing base certificate

► Asset-based debt outstanding cannot exceed borrowing base

► NOLV appraisal and advance rate updated 1-3 times a year

Lending benchmarks:

● PPE: 20% to 40% of book value on average

● Inventory: 50% to 60% of book value on average for eligible inventory (∼80% eligible)

● Receivable: 80% of book value on average for eligible receivable (∼80% eligible)

● Can vary for different industries

Kermani and Ma (2022): liquidation value data for different types of assets and industries

● On average matches lending benchmarks very closely

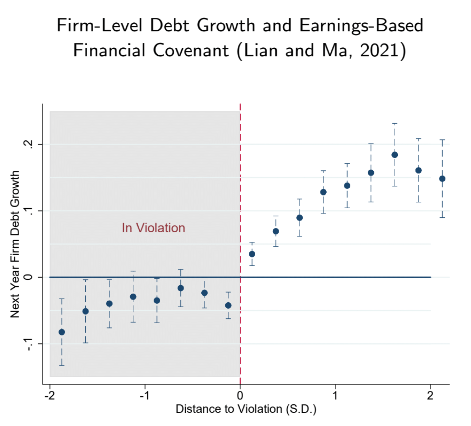

Debt Limit: Cash Flow-Based Debt

Contractual borrowing constraints not based on qk

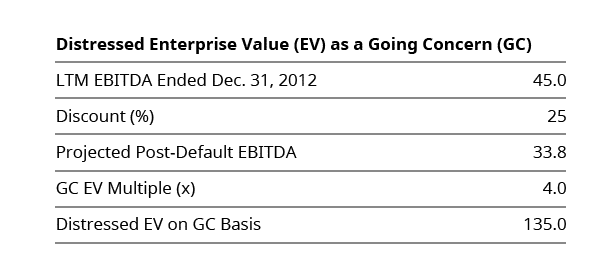

When cash flow-based debt present, contracts commonly require total borrowing ≤ θπ

● π is EBITDA (earnings before interest, taxes, depreciation, and amortization) in past 12m

● Constraint commonly applies to total debt, not a particular contract. θ typically 4 to 6

► π (EBITDA) is also at the firm level

► Total creditor payoff in Chapter 11 given by firm going-concern value, often approximated by EBITDA multiples

Borrowing limit often included in legally binding financial covenants; violation is breach of contract

● Loan covenants typically require compliance every quarter

► Covenant-lite (cov-lite) loans require compliance when borrower takes certain actions instead of quarterly (like bond covenants)

● Bond covenants require compliance when firm takes certain actions (e.g., issue new debt)

● Violation has consequences for borrowing (see more below) also firm operations, management (Roberts and Sufi, 2009; Nini, Smith and Sufi, 2012)

Total debt ≤ function of EBITDA

● Form 1: Debt to EBITDA constraint (e.g., outstanding debt ≤ multiples of EBITDA)

● Form 2: Coverage ratio constraint (e.g. interest payment ≤ fraction of EBITDA)

● One type or both types can be included in a contract

Formula specified at origination

● Contracts may specify debt/EBITDA ratio or coverage ratio that changes over time

● EBITDA defined by contracts, may exclude certain expenses

● Some contracts may specify exceptions (called “deductibles”/“carve outs”/“baskets”)

► Such as specifying borrowing ≤ constant + θπ; see Ivashina and Vallee (2020)

Secured Debt

Essence: priority (in bankruptcy) in the US

Secured debt can take priority over different things (priority is “multidimensional”):

Approach 1:

Priority over value of particular assets, e.g., land, equipment, inventory

Priority over value of particular assets, e.g., land, equipment, inventory

● Collateral value: value of particular assets pledged

● Asset-based debt: establishes clear priority over particular assets through explicit security interest

Approach 2:

Priority over value of firm (e.g., through blanket liens on firm)

● Collateral value: going-concern value of firm − value of particular assets separately pledged

● Part of cash ow-based debt (e.g., common in syndicated loans)

● Blanket liens for small business lending can be different

Unsecured debt: low priority, can also be explicitly subordinated

Terminology: Contracts

and Economics Literature

Contracts and law:

Uniform Commercial Code, Article 9, § 102.Definitions

● ”Collateral” means the property subject to a security interest...

US Bankruptcy Code, § 101.Definitions

● The term “security interest” means lien created by an agreement.

“Collateral” associated with security interest (not always w/ tangible assets)

Economics literature:

Collateral constraint”: b ≤ qk (debt less than a fraction of physical assets)

“Collateral” not necessarily associated with security (but typically w/ tangible assets)

Be careful about terms “collateral,” “secured” in contracts vs. traditional economic references

Bankruptcy: Background

Bankruptcy ≠ business failure

Many unsuccessful businesses just shut down.

● Bankruptcy needs petition to start. Business failure does not.

Many businesses go through bankruptcy to restructure and continue operations.

● See Gilson (2010)

General division: Chapter 11 (restructuring), Chapter 7 (liquidation)

Creditor payoff: first determine total size of pie, then distribute based on priority

● Chapter 11: total size of pie given by firm going-concern value

● Chapter 7: total size of pie given by total liquidation value

Bankruptcy laws matter for verifiability, payment rules, etc. ⇒ important for contracts ex ante

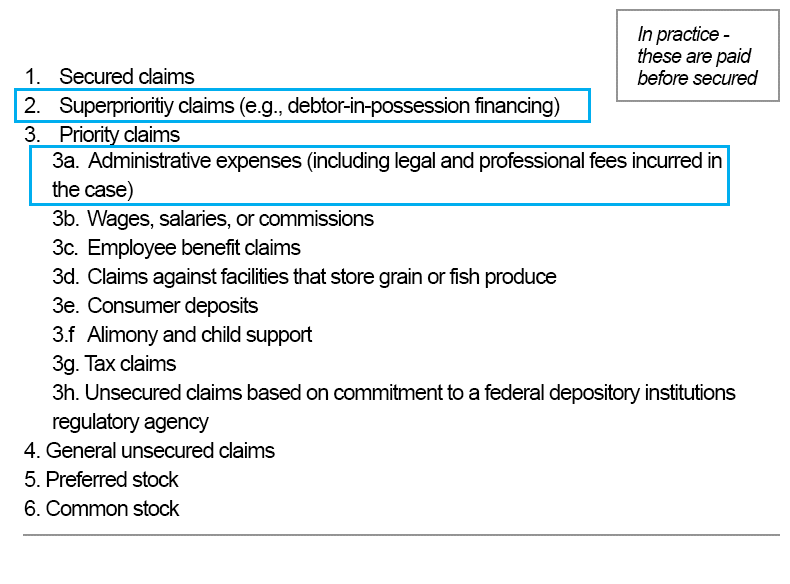

Priority

Hierarchy of Claims

Determinants of priority:

Security, contractual subordination, structural subordination, pre/post petition claims

Security and Priority

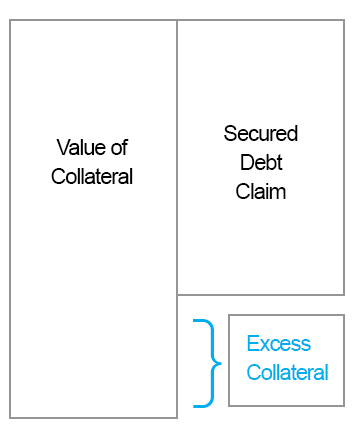

Over-collateralized Secured Debt

● If value of collateral > secured debt claim, then....

● Secured debt can receive adequate protection in Chapter 11; if collateral value drops below the claim, then the company must pay the secured cash to keep them "whole"

● Secured also receives or accrues cash interest during Chapter 11 up to the amount of the excess collateral

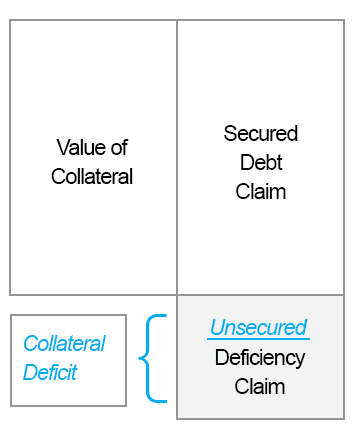

Under-collateralized Secured Debt

● If value of collateral < secured debt claim, then....

● Claim is split into two pieces - a secured claim (value of collateral) and an unsecured claim (value of deficit). Each claim gets a vote.

● Secured will not receive or accrue cash interest during Chapter 11

● Unsecured claims do not receive or accrue interest during Chapter 11 (confirmed with recent EFH case)

Forms of security and collateral value (mentioned before):

Security interest in particular assets

● Collateral value: value of

particular assets pledged

particular assets pledged

Blanket lien on firm as a whole

● Collateral value: going-concern

value of firm−value of particular

assets separately pledged

value of firm−value of particular

assets separately pledged

On Pledging Receivables and Inventory

Lenders call them “asset-based lending” and use borrowing base given by liquidation value

● Lenders call them “asset-based lending” and use borrowing base given by liquidation value

► See borrowing base certificate example above

● Mainly used for revolving credit lines; pledging fixed assets used in term loans

But receivables/inventory could have different economic properties than pledging fixed assets

● Caglio, Darst and Kalemli-Özcan (2021)

Without them the amount of asset-based debt would be even smaller

● Pledging fixed assets/real estate: ~7% of corporate debt outstanding by value

● Pledging inventory/receivables: ~13% of corporate debt outstanding by value

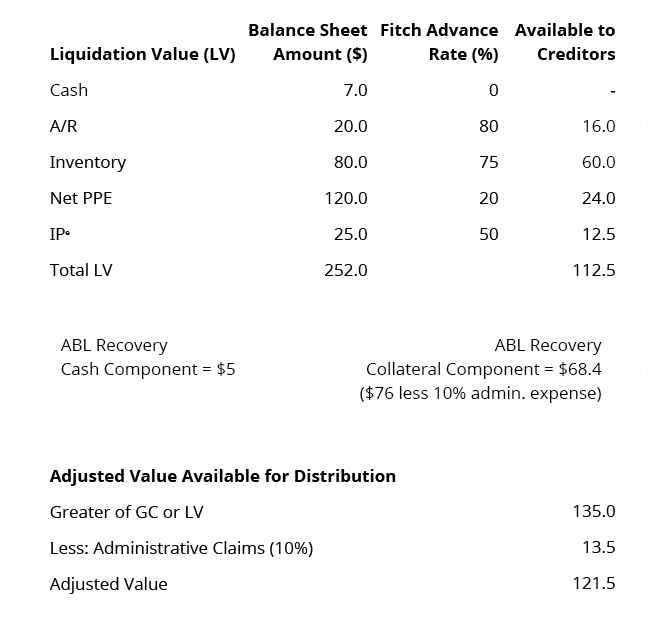

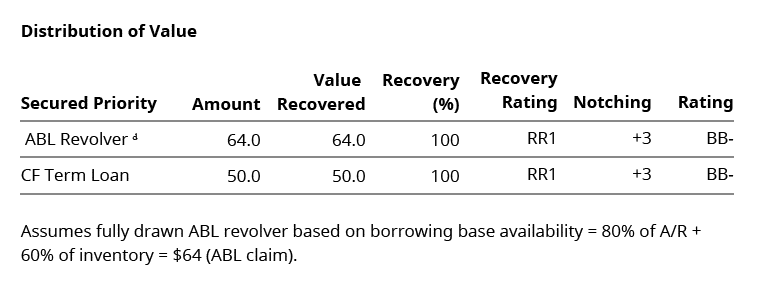

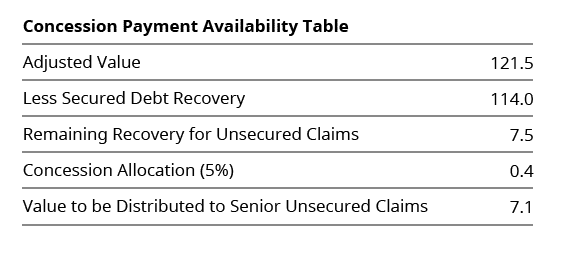

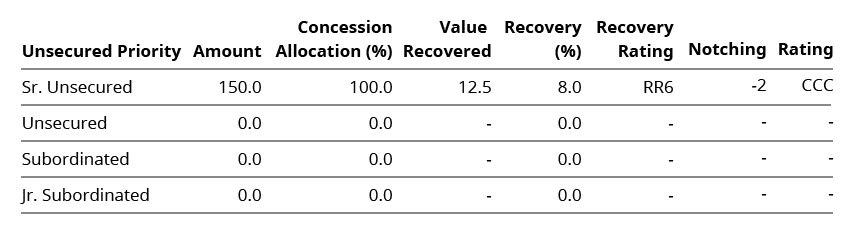

Examples from Fitch

If outstanding ABL > liquidation value of assets pledged to ABL

► Then ABL has secured claim (senior) = value of assets pledged to ABL + an unsecured claim (deficiency claim) = debt amount -value of assets pledged to ABL

► Deficiency claim is less senior than the blanket lien of secured cash flow-based debt

Fitch recognizes that an ABL is entitled to priority over other first lien cash flow-based debt to the extent of the value of specific collateral securing the ABL. Therefore, in allocating the adjusted enterprise value to the two classes of senior secured claims, Fitch first allocates the portion attributable to the liquidation value of the specific assets securing the ABL; and the enterprise value for the other first lien debt is net of the amount allocated to the ABL collateral component.