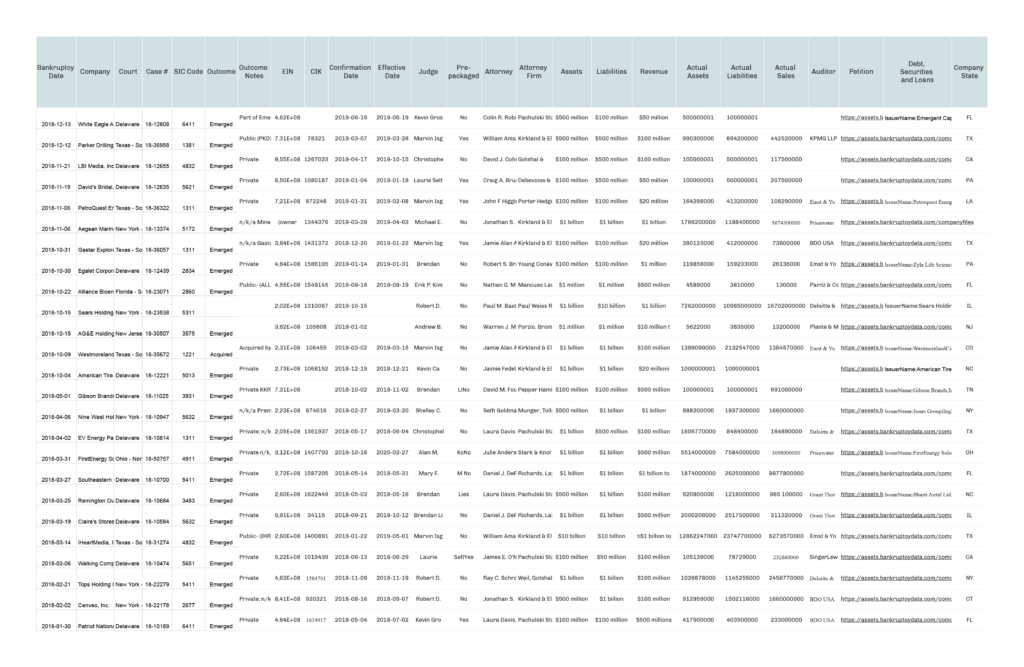

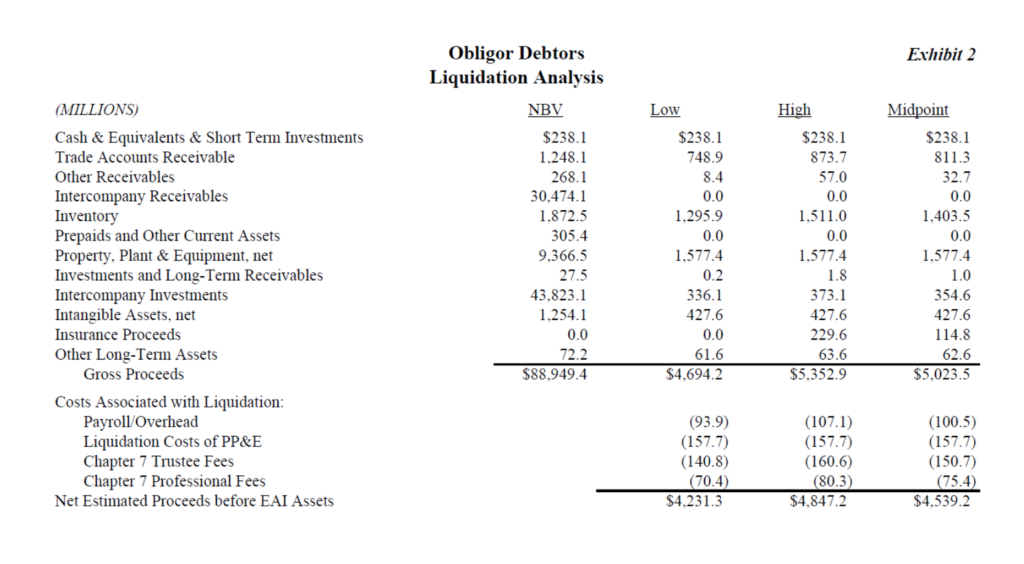

The liquidation analysis typically includes a summary table with the net book value, liquidation value, and liquidation recovery rate (liquidation value as a fraction of net book value) for each main category of asset (e.g., PPE, inventory, receivable) and for the firm as a whole, together with notes that explain the sources and assumptions of the estimates. We use the midpoint estimate of the liquidation value in the summary table and the average of high and low estimates when the midpoint is not available. See an example of the liquidation analysis summary table from Lyondell Chemical here.

See the full liquidation analysis with more detailed information here.

Our main dataset relies on public companies for the main dataset because information is considerably harder to obtain for private companies. For instance, most bankruptcy filings do not contain an industry classification of the company. For public firms, NGR has assembled background company information including SIC codes, which we checked by hand using industry codes reported for their SEC registration. For private firms, it is difficult to find reliable industry classification just based on company name in the bankruptcy filing. It is also more common that we cannot find the liquidation analysis document in PACER. However, we do collect additional data using the list of “Large Private Filings” compiled by the NGR, where they cleaned the filing data and collected SIC codes.

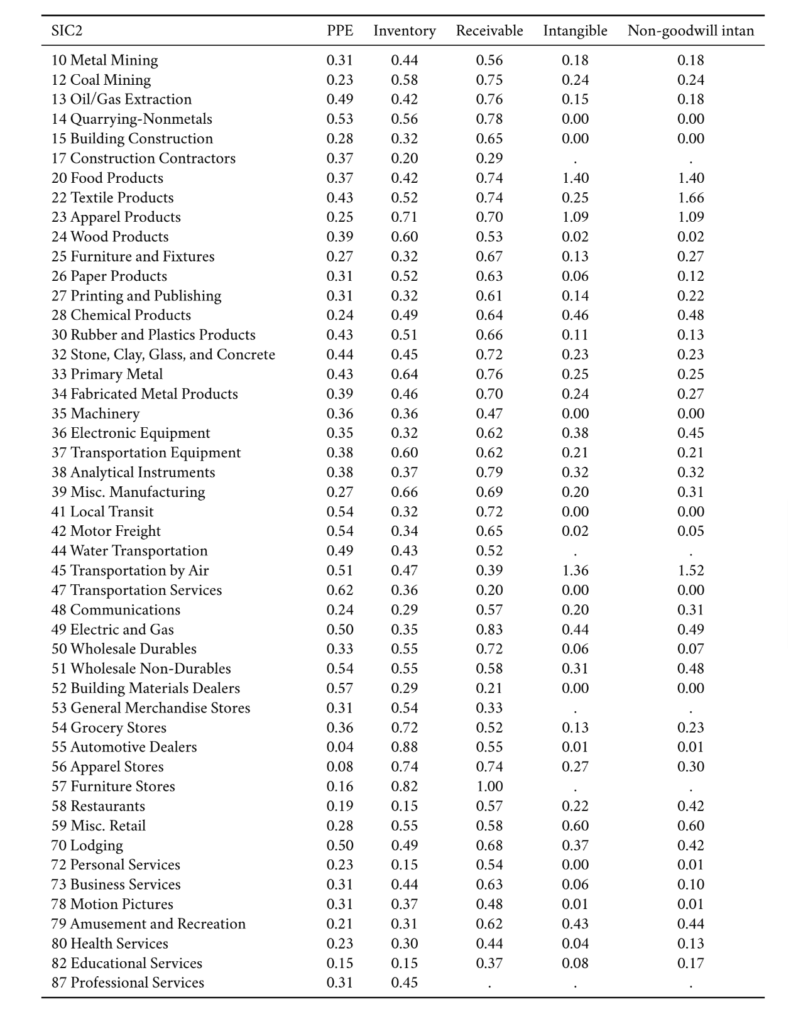

For each type of asset, we also construct average liquidation recovery rate in an industry. The main asset categories include fixed assets (PPE), inventory, receivable, and book intangible, which correspond to the standard categories in financial statements. Each industry is a two-digit SIC code. Averaging by industry has two functions. First, the industry-level measures can reduce idiosyncratic noise at the individual case level. Second, they can be extended to firms in each industry more broadly.

2

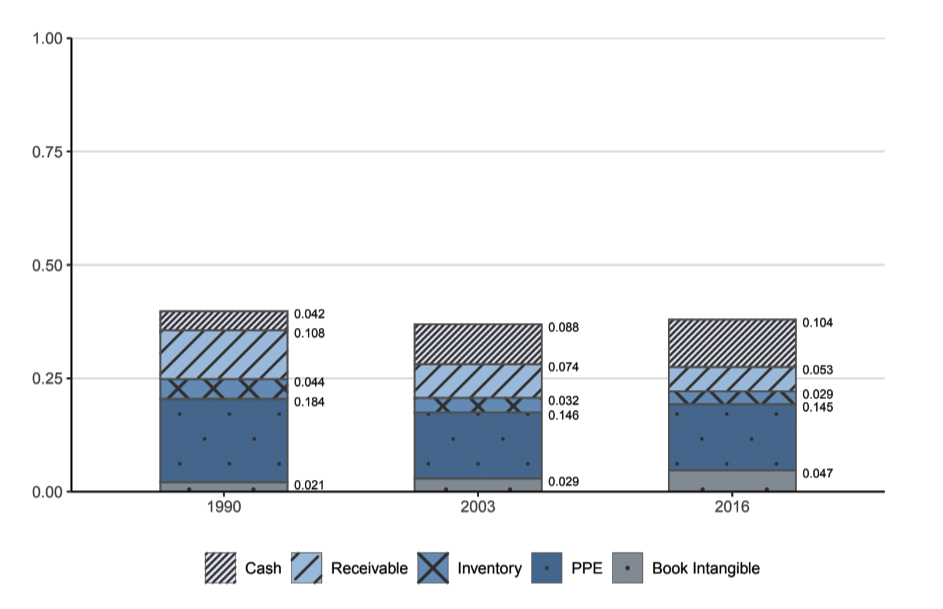

Liquidation Value over Time

(Compustat Aggregate)

3

where Liq i,t is the total liquidation value of firm i at time t , j denotes the asset type (e.g., PPE, inventory), λ i,j is the industry-average liquidation recovery rate for this type of asset (based on the firm’s industry), and K i,j,t is the book value of asset j for firm i at time t .

where Liq i,t is the total liquidation value of firm i at time t , j denotes the asset type (e.g., PPE, inventory), λ i,j is the industry-average liquidation recovery rate for this type of asset (based on the firm’s industry), and K i,j,t is the book value of asset j for firm i at time t .