Economic Conditions

and Liquidation Values

using fixed assets as the main example.

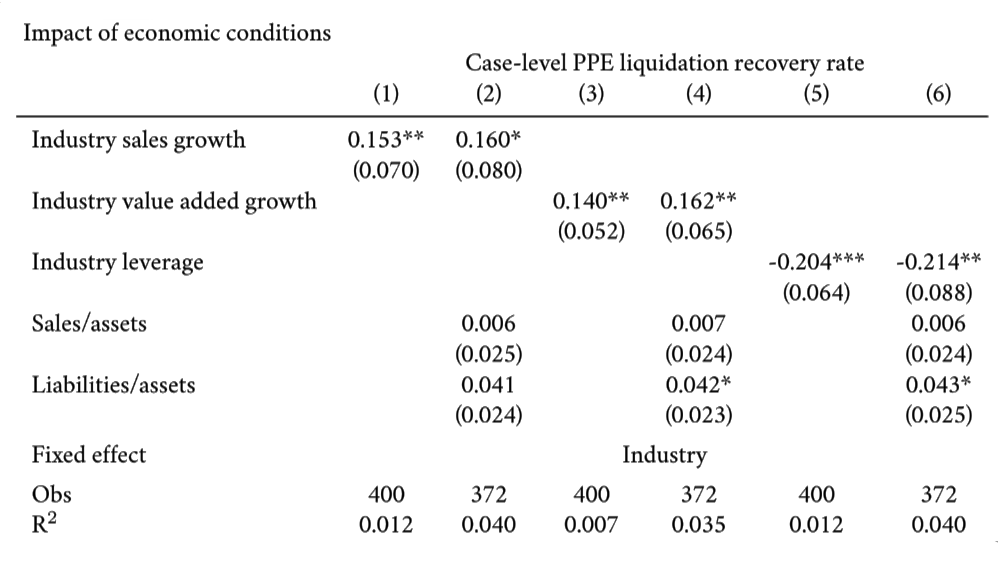

Shleifer and Vishny (1992) highlight that time-varying economic conditions influence the capacity of alternative users. We use three variables to capture industry conditions:

1) industry-average sales growth in Compustat over the past four quarters prior to the liquidation analysis

2) industry value added growth in national accounts over the past year

3) industry-average book leverage (debt/assets) in Compustat in the quarter prior to the liquidation analysis.

We analyze the liquidation recovery rate of property, plant, and equipment (PPE) of each firm, and control for industry fixed effects to study how the liquidation recovery rate within an industry changes over time with economic conditions.

● In terms of magnitude, when industry growth increases by 10 percentage points, liquidation recovery rates on average increase by 1.5 percentage points.

● The standard deviation of industry growth is about 15 percentage points, so a two standard deviation change in industry growth would on average shift PPE liquidation recovery rates by 5 percentage points.

● In terms of magnitude, when industry leverage increases by 10 percentage points, liquidation recovery rates on average decrease by 2 percentage points.

● The standard deviation of industry leverage is about 18 percentage points, so a two standard deviation change in industry leverage would on average shift PPE liquidation recovery rates by 7 percentage points.

● Overall, the magnitude is relatively mild. Variation in industry conditions does not seem to drastically change the general level of liquidation recovery rates; it also does not easily change the differences across industries (e.g., industry conditions need to change by more than two standard deviations to shift the PPE liquidation recovery rate by more than quartile).

Overall, our results provide evidence for cyclical variations in liquidation values; nonetheless, these fluctuations do not change the overall picture of high asset specificity.