Impact of Intangibles

Overview

Classic investment theories have focused on investment in fixed assets (or “tangible” capital). Recent research documents that a key development in the past few decades is the growing importance of intangible assets, broadly defined as production assets without physical presence. Intangible assets include identifiable components such as computerized information (software, data, recordings), usage rights (licenses, excavation rights, route rights, domain names, etc.), patents and technologies, and brands, which are separable and transferable to alternative users on a standalone basis. They also include organizational capital, firm-specific human capital, and other forms of “economic competencies,” which are not necessarily independently identifiable or separable from the firm. Overall, intangible capital includes different sets of non-physical assets, which can differ in their economic properties. In addition, only a subset of intangible assets are currently reported among firms’ assets in financial statements, which are often referred to as book intangibles.

What is the fundamental difference between physical and intangible assets? A major concern in recent research is that rising intangibles could deplete firms’ liquidation values. We document that the rise of intangible assets so far has not had a first-order impact on firms’ liquidation values, contrary to conventional wisdom.

Categories

A subset of intangible assets are currently reported among firms' assets in financial statements, which are often referred to as book intangibles. These represent intangibles purchased from outside.

Intanbook,separable: this category includes identifiable intangible assets acquired from outside, such as licenses, patents, customer data, and tradenames. We observe their liquidation recovery rates in our data. Three-quarters of cases in our data report the liquidation recovery rate of non-goodwill intangibles separately whereas one quarter only report the combined liquidation recovery rate of all book intangibles. In the latter situation, we estimate the liquidation recovery rate of non-goodwill intangibles as the combined liquidation recovery rate divided by the share of non-goodwill intangibles in book intangibles in the industry (as goodwill generally has no liquidation value as explained below).

Other intangible assets are not reported in firms financial statements (not “capitalized"). Their quantity is challenging to measure and Peters and Taylor (2017) provide some estimates.

4.

Findings

This table shows the estimated liquidation value of all Compustat firms for three example years (1996, 2006, and 2016), as a share of total book value and as a share of total enterprise value (market value of equity plus book value of debt). Liquidation values include those from (non-goodwill) book intangibles, PPE, working capital, and cash. As explained above, we assume all other types of intangible assets have zero liquidation value to be conservative, so our results provide a lower bound for the liquidation value of intangibles.

In particular, physical assets are already highly specific in many industries. From 1996 to 2016, the share of PPE in total assets among Compustat firms declined by 8 percentage points. Even if all intangible assets have zero liquidation value, the decline in PPE would only reduce total liquidation values by 2 percentage points of book assets.

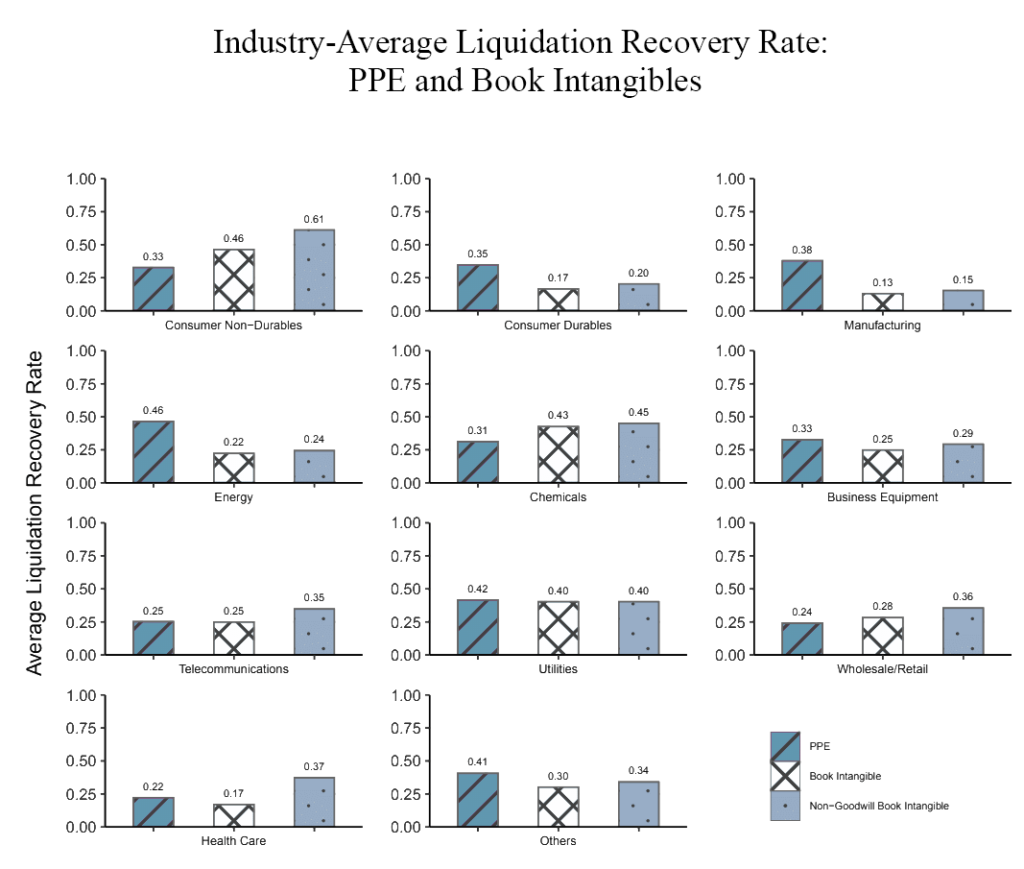

In addition, at least for identifiable book intangibles, their liquidation recovery rates are not necessarily much lower than those of PPE (e.g., transferring intangibles do not incur transportation costs). It turns out that the increase in this group of intangible assets alone raises total liquidation values by about 2 percentage points of book assets, which offsets the impact of the decline in fixed assets. The following figure plots the average liquidation recovery rate of PPE and that of book intangibles for Fama-French 12 industries (except finance). For each industry, the first bar represents the average PPE liquidation recovery rate, the second bar represents the average book intangible liquidation recovery rate, and the third bar represents the implied liquidation recovery rate of non-goodwill book intangibles. We see that the second bar, and especially the third bar, are not much lower than the first bar.

Summary

In summary, our data shows that rising intangibles may not substantially reduce firms' liquidation values. Accordingly, it is unclear that the primary impact of this development is tighter borrowing constraints due to lower liquidation values. Furthermore, in the US, firms' debt capacity is not necessarily tied to liquidation values, especially when firms have positive earnings. Indeed, as intangible assets become more prevalent over time, the leverage among US nonfinancial firms has been rising rather than falling.

What then is different about intangibles? One possibility is that intangibles can be more scalable. For instance, since intangibles are non-physical and not bound by particular locations, they can be used at multiple places simultaneously (e.g., enterprise planning systems, brands, data). Greater scalability provides advantages to large firms. Additionally, intangible assets raise a number of questions about the proper measurement of economic activities such as growth, investment, and productivity. These areas are likely to be more central for the difference between intangible assets and physical assets.

Intangible Accounting – Annual Report from 3M

Text from page 52 of the 2021 Annual Report:

Intangible assets: Intangible asset types include customer related, patents, other technology-based, tradenames and other intangible assets acquired from an independent party. Intangible assets with a definite life are amortized over a period ranging from five years to twenty years on a systematic and rational basis (generally straight line) that is representative of the asset’s use. The estimated useful lives vary by category, with customer-related largely between ten to twenty years, patents largely between seven to thirteen years, other technology-based largely between six to twenty years, definite lived tradenames largely between six and twenty years, and other intangibles largely between five to eight years. Intangible assets are removed from their respective gross asset and accumulated amortization accounts when they are no longer in use. Refer to Note 4 for additional details on the gross amount and accumulated amortization of the Company’s intangible assets. Costs related to internally developed intangible assets, such as patents, are expensed as incurred, within “Research, development and related expenses.”

Intangible assets with a definite life are tested for impairment whenever events or circumstances indicate that the carrying amount of an asset (asset group) may not be recoverable. An impairment loss is recognized when the carrying amount exceeds the estimated undiscounted cash flows from the asset’s or asset group’s ongoing use and eventual disposition. If an impairment is identified, the amount of the impairment loss recorded is calculated by the excess of the asset’s carrying value over its fair value. Fair value is generally determined using a discounted cash flow analysis.

Intangible assets with an indefinite life, namely certain tradenames, are not amortized. Indefinite-lived intangible assets are tested for impairment annually, and are tested for impairment between annual tests if an event occurs or circumstances change that would indicate that the carrying amount may be impaired. An impairment loss would be recognized when the fair value is

less than the carrying value of the indefinite-lived intangible asset.