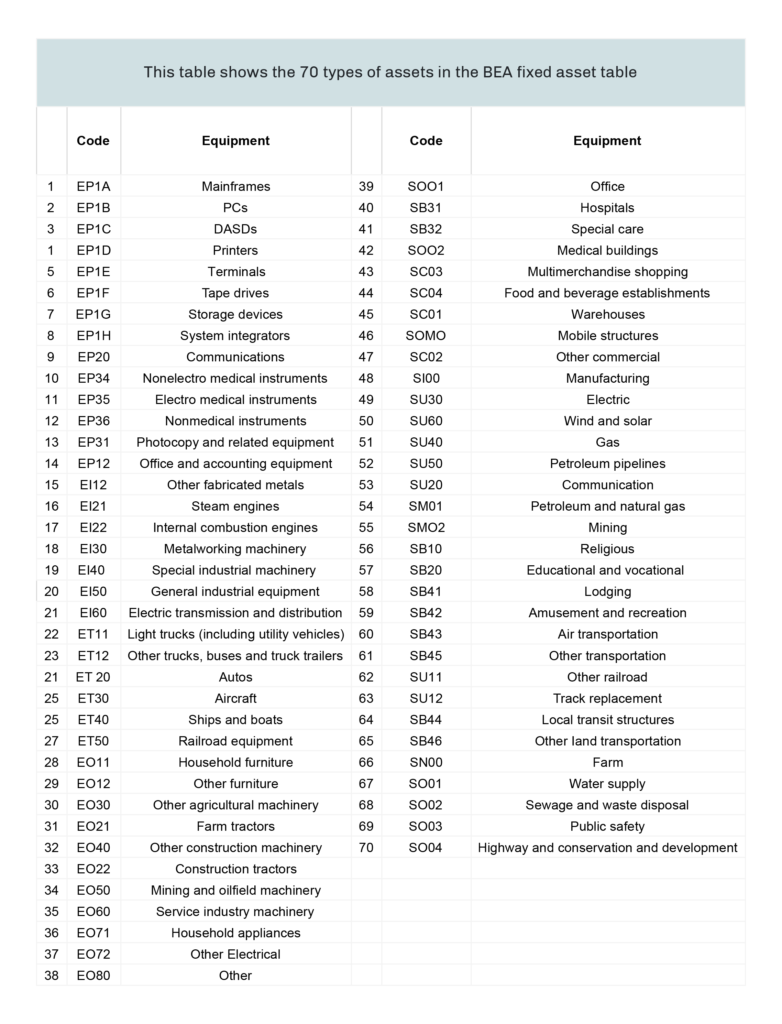

To study the physical attributes of PPE in each industry, a helpful starting point is the BEA’s fixed asset table, which records the stock of 38 types of equipment and 32 types of structures across 58 BEA industries (we exclude the category “nuclear fuel,” which does not appear to be a type of fixed asset), see here. We denote the fixed asset stock as K i,j , where i is a BEA industry and j is one type of fixed asset. We analyze the physical attributes of each type of fixed asset j , and then assess the overall characteristics of PPE in an industry i using the fixed asset composition (the share of K i,j in